Biden's Student Debt Plan: Original Authors Dispute Legal Basis

Discover more detailed and exciting information on our website. Click the link below to start your adventure: Visit Best Website. Don't miss out!

Table of Contents

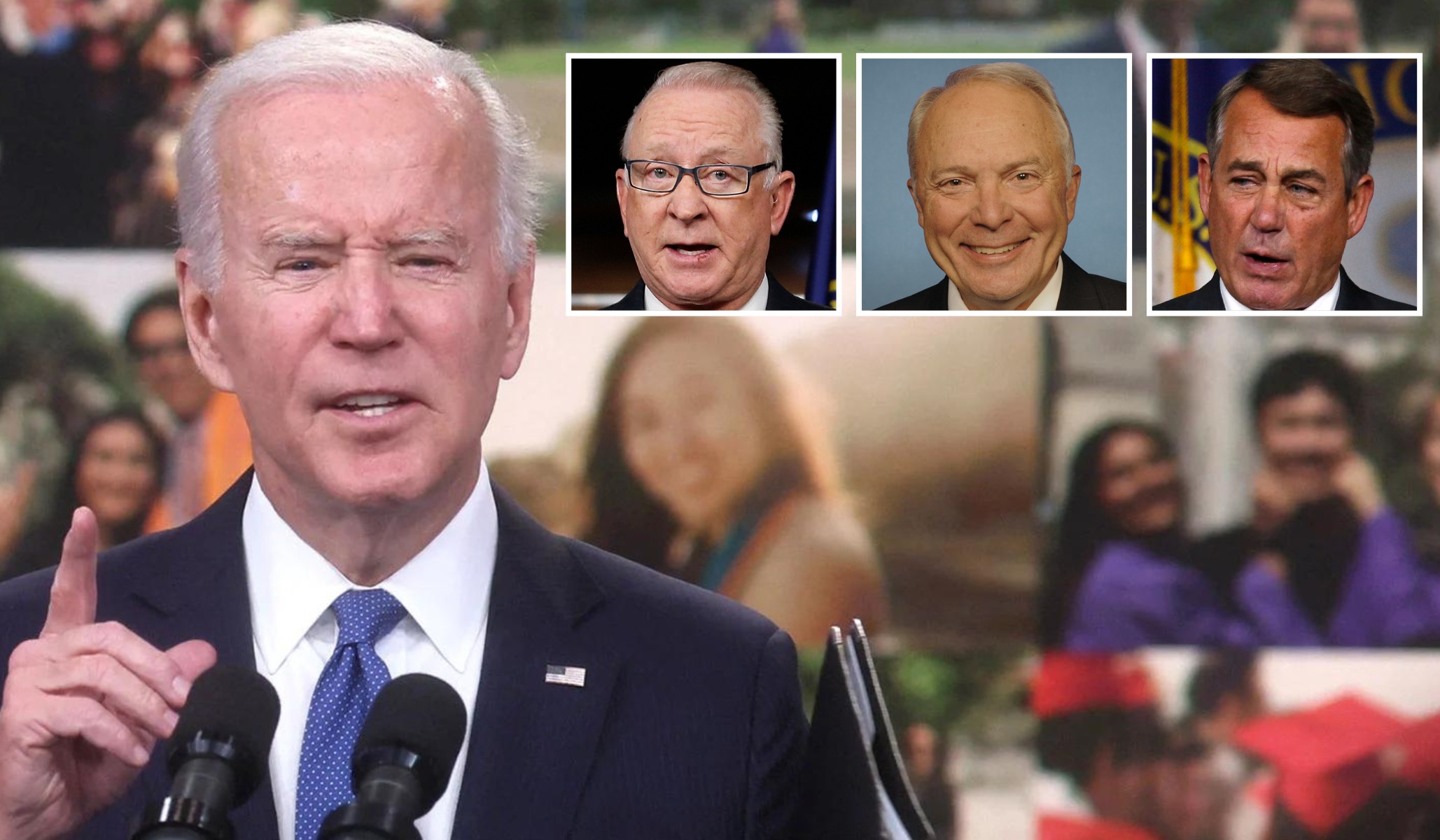

Biden's Student Loan Forgiveness Plan Faces Legal Headwinds: Original Authors Dispute Legal Basis

President Biden's ambitious plan to wipe out or significantly reduce student loan debt for millions of Americans is facing serious legal challenges. The plan, hailed by supporters as a vital step towards economic equality, is now embroiled in controversy as the original authors of the HEROES Act of 2003 – the law Biden's administration cites as the legal basis for the program – publicly dispute its applicability. This raises serious questions about the plan's future and its potential impact on borrowers nationwide.

The Core Controversy: HEROES Act Interpretation

The Biden administration argues that the HEROES Act of 2003 grants the Secretary of Education the authority to modify or waive student loan programs in times of national emergency. Given the ongoing economic fallout from the COVID-19 pandemic, the administration believes this authority justifies the sweeping loan forgiveness program. However, this interpretation is now being challenged by key figures involved in drafting the HEROES Act.

These authors contend that the Act's language was never intended to encompass such a broad-scale debt cancellation program. They argue that the intent was to provide targeted relief to individuals facing specific hardships, not a blanket forgiveness program affecting millions. This stark difference in interpretation forms the heart of the legal battle now brewing.

Legal Challenges Mount Against Student Loan Forgiveness

Several lawsuits have already been filed challenging the legality of the Biden administration's plan. These lawsuits argue that the plan exceeds the authority granted under the HEROES Act, is economically unsound, and violates the principles of equal protection under the law. The plaintiffs in these cases raise concerns about the fairness of forgiving the debt of some borrowers while others continue to shoulder their financial burden.

- Arguments against the plan often cite:

- Lack of Congressional Authorization: Critics argue that such a significant financial undertaking requires explicit Congressional authorization, which is currently lacking.

- Economic Impact Concerns: Opponents express concerns about the potential inflationary impact of widespread debt cancellation and the fairness of taxpayers footing the bill for the program.

- Equal Protection Concerns: Lawsuits allege that the plan unfairly benefits certain demographics while leaving others unaffected.

What Happens Next? The Uncertain Future of Student Loan Forgiveness

The legal challenges facing President Biden's student loan forgiveness plan are substantial. The outcome of these lawsuits will determine the fate of the program and could have far-reaching implications for millions of borrowers. A court ruling against the plan could lead to its complete dismantling, leaving borrowers in a state of uncertainty.

Understanding the implications is crucial for:

- Borrowers: Those who applied for forgiveness should closely monitor legal developments and understand their potential impact.

- Taxpayers: The financial implications of the program, regardless of its ultimate fate, will impact taxpayers across the country.

- Policymakers: The outcome of these lawsuits will shape future discussions about student loan debt and government intervention.

The coming months will be critical in determining the fate of Biden's student loan forgiveness plan. The legal battles ahead will likely shape not only the future of this specific program but also the broader debate around student loan debt and the government's role in addressing it. Stay informed and follow the unfolding legal developments to understand how this pivotal issue will impact you. For further information, consult legal experts and reliable news sources.

Thank you for visiting our website wich cover about Biden's Student Debt Plan: Original Authors Dispute Legal Basis. We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and dont miss to bookmark.

Featured Posts

-

Mapping Mars The Scientific Battles That Fueled Exploration

Jan 26, 2025

Mapping Mars The Scientific Battles That Fueled Exploration

Jan 26, 2025 -

Walk It Out Rapper Dj Unk Dies At 43 Fans Mourn The Loss

Jan 26, 2025

Walk It Out Rapper Dj Unk Dies At 43 Fans Mourn The Loss

Jan 26, 2025 -

76ers X Cavaliers Transmissao Ao Vivo Nba Playoffs

Jan 26, 2025

76ers X Cavaliers Transmissao Ao Vivo Nba Playoffs

Jan 26, 2025 -

Teslas China Recall 1 2 Million Cars Impacted By Safety Software Update

Jan 26, 2025

Teslas China Recall 1 2 Million Cars Impacted By Safety Software Update

Jan 26, 2025 -

No 5 Lsu At No 2 South Carolina Live Stream And Tv Info

Jan 26, 2025

No 5 Lsu At No 2 South Carolina Live Stream And Tv Info

Jan 26, 2025

Latest Posts

-

L Impact De Forza Horizon 5 Sur Le Marche Xbox Decryptage

Feb 01, 2025

L Impact De Forza Horizon 5 Sur Le Marche Xbox Decryptage

Feb 01, 2025 -

Man Shot Dead In Sweden Following Koran Burning Authorities Investigating

Feb 01, 2025

Man Shot Dead In Sweden Following Koran Burning Authorities Investigating

Feb 01, 2025 -

6 Nations 2025 Horaires Chaines De Television Et Arbitres Designes

Feb 01, 2025

6 Nations 2025 Horaires Chaines De Television Et Arbitres Designes

Feb 01, 2025 -

What The Syrian Secret Police Observed During The Regimes Downfall

Feb 01, 2025

What The Syrian Secret Police Observed During The Regimes Downfall

Feb 01, 2025