Legal Experts Challenge Biden's Authority On Student Loan Forgiveness

Discover more detailed and exciting information on our website. Click the link below to start your adventure: Visit Best Website. Don't miss out!

Table of Contents

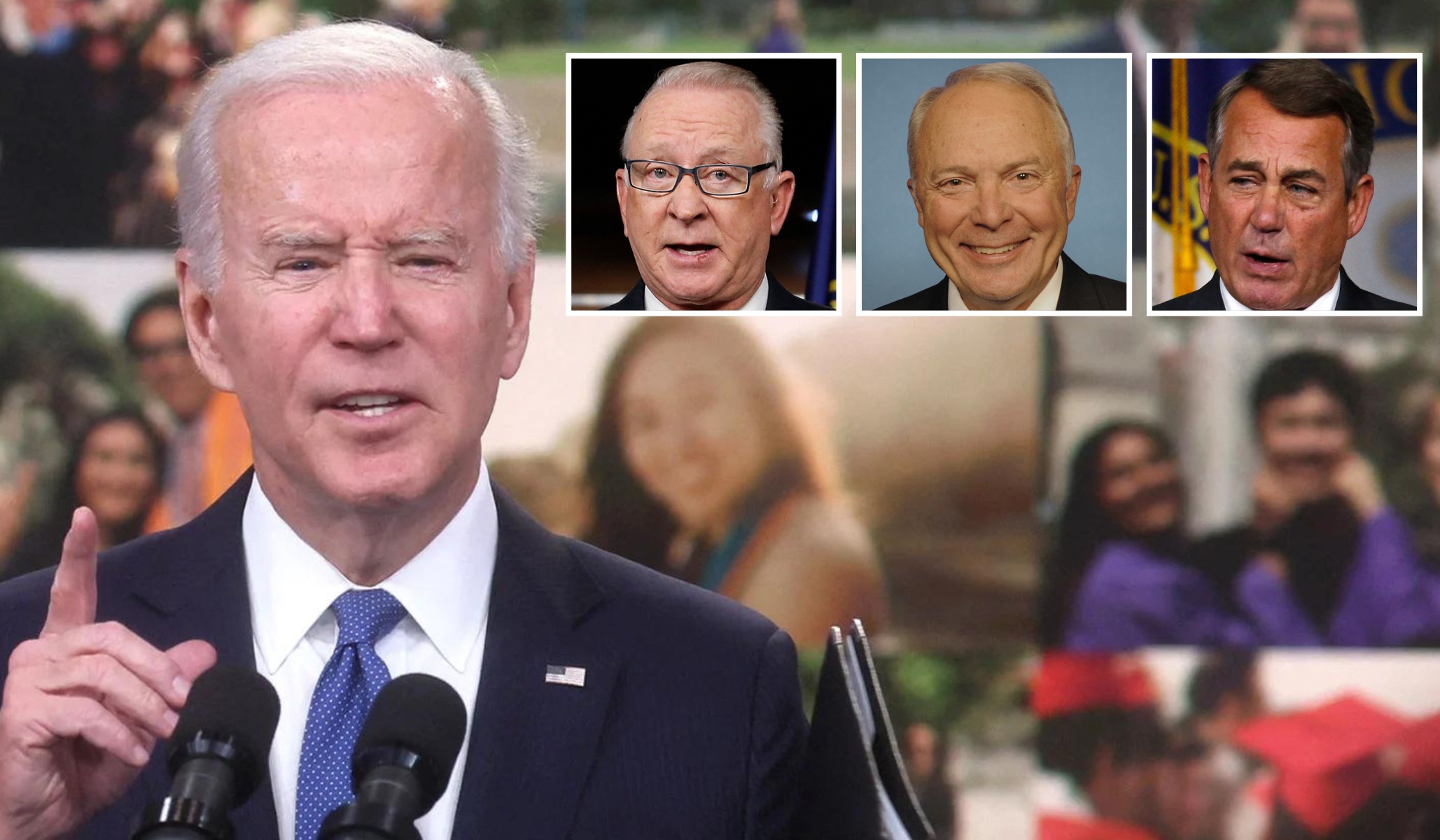

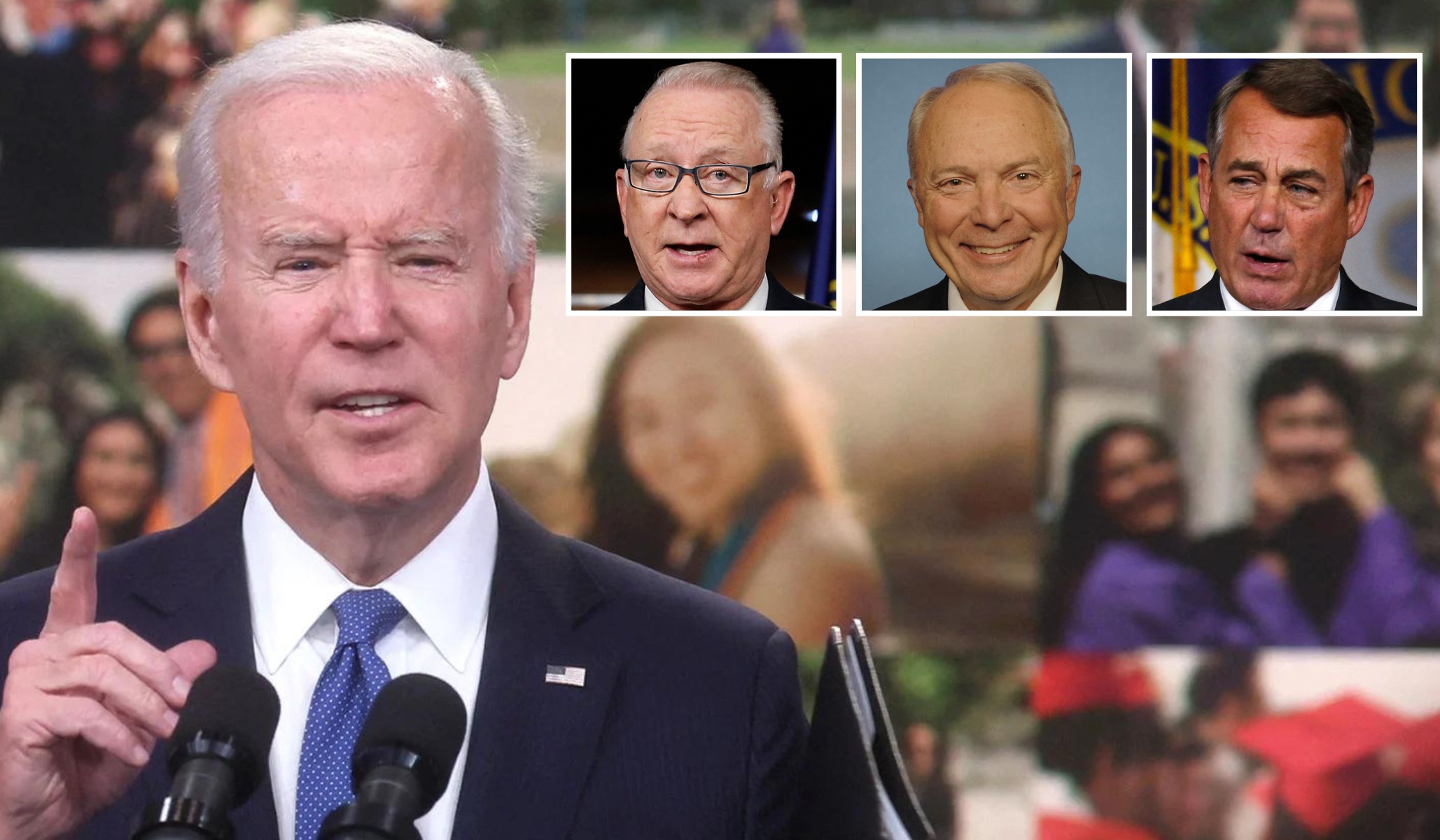

Legal Experts Challenge Biden's Authority on Student Loan Forgiveness: A Looming Constitutional Showdown?

President Biden's ambitious plan to wipe out or significantly reduce student loan debt for millions of Americans has ignited a firestorm of controversy, with legal experts lining up to challenge the legality of the executive action. This unprecedented move, impacting an estimated 43 million borrowers and potentially costing over $400 billion, faces significant headwinds, raising fundamental questions about the separation of powers and the extent of presidential authority. The legal battles brewing could determine the fate of this landmark policy and set a precedent for future executive actions.

H2: The Core Arguments Against Biden's Plan

Critics argue that the HEROES Act of 2003, the legal basis cited by the administration, does not grant the President the sweeping power to unilaterally cancel student loan debt. The key arguments raised by legal scholars and organizations challenging the plan include:

- Lack of Explicit Congressional Authorization: Opponents contend that the HEROES Act, while allowing for modifications to student loan programs during national emergencies, doesn't explicitly authorize mass debt cancellation. They argue that such a significant financial undertaking requires explicit Congressional approval.

- Constitutional Concerns Regarding Spending Authority: A central argument revolves around the Constitution's allocation of spending power to Congress. By unilaterally canceling billions in debt, the administration is, in the eyes of critics, usurping Congress's power of the purse. This argument highlights the potential for future presidents to circumvent Congress on major financial decisions.

- Equal Protection Concerns: Legal challenges also highlight potential violations of the Equal Protection Clause of the Fourteenth Amendment. Some argue that the plan unfairly benefits certain groups of borrowers while leaving others with substantial debt. This disparity forms the basis of several lawsuits.

- Potential for Unintended Economic Consequences: Beyond the legal arguments, opponents raise concerns about the potential inflationary impact of widespread debt forgiveness and its effect on the overall economy. These economic arguments are often intertwined with the legal challenges.

H3: The Legal Battles Ahead: Lawsuits and Potential Supreme Court Review

Several lawsuits have already been filed challenging the plan in federal courts across the country. These cases involve various plaintiffs, including individual borrowers and states, each raising different legal arguments. The outcome of these lawsuits will be crucial, and experts predict a protracted legal battle that could ultimately reach the Supreme Court. The Supreme Court's decision will set a significant precedent regarding executive power and the limits of presidential action in matters of significant financial impact.

H3: The HEROES Act: A Point of Contention

The HEROES Act of 2003, designed to provide relief to student loan borrowers in times of national emergency, has become the central focus of the legal debate. While the Biden administration argues the ongoing economic fallout from the COVID-19 pandemic qualifies as such an emergency, opponents argue that the Act's language doesn't provide the authority for the scale of debt cancellation undertaken. This interpretation of the law is at the heart of the legal challenges.

H2: What Happens Next? The Uncertain Future of Student Loan Forgiveness

The future of President Biden's student loan forgiveness plan remains highly uncertain. The legal challenges pose a significant threat to its implementation. The outcome could hinge on the interpretation of the HEROES Act and the courts' willingness to limit executive power. Regardless of the legal outcome, this debate highlights the crucial tension between executive action and Congressional authority in navigating major economic policy decisions. The next few months will be critical as courts begin to hear arguments and issue rulings in these consequential cases. Stay informed and follow the developments in this ongoing legal battle.

Thank you for visiting our website wich cover about Legal Experts Challenge Biden's Authority On Student Loan Forgiveness. We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and dont miss to bookmark.

Featured Posts

-

Dapatkan Hadiah Kode Redeem Fc Mobile Januari 2025

Jan 25, 2025

Dapatkan Hadiah Kode Redeem Fc Mobile Januari 2025

Jan 25, 2025 -

Paralysis Fears Sydney Health Alert After Botox Treatment Complications

Jan 25, 2025

Paralysis Fears Sydney Health Alert After Botox Treatment Complications

Jan 25, 2025 -

Pete Alonso To Toronto Blue Jays And Mets In Advanced Trade Discussions

Jan 25, 2025

Pete Alonso To Toronto Blue Jays And Mets In Advanced Trade Discussions

Jan 25, 2025 -

Australian Open Sinner Contro Zverev Un Confronto Numerico

Jan 25, 2025

Australian Open Sinner Contro Zverev Un Confronto Numerico

Jan 25, 2025 -

Oscars 2025 Alle Nominierungen Und Deutsche Beteiligung

Jan 25, 2025

Oscars 2025 Alle Nominierungen Und Deutsche Beteiligung

Jan 25, 2025

Latest Posts

-

Dinamo Zagreb Vs Milan Minuto A Minuto En Directo

Jan 31, 2025

Dinamo Zagreb Vs Milan Minuto A Minuto En Directo

Jan 31, 2025 -

Dinamo Zagreb X Milan Data Horario Onde Assistir E Provaveis Times

Jan 31, 2025

Dinamo Zagreb X Milan Data Horario Onde Assistir E Provaveis Times

Jan 31, 2025 -

Thornton Township Board Meeting Descends Into Chaos

Jan 31, 2025

Thornton Township Board Meeting Descends Into Chaos

Jan 31, 2025 -

Sony In Zone Monitors 3 Year Warranty Tackles Oled Burn In

Jan 31, 2025

Sony In Zone Monitors 3 Year Warranty Tackles Oled Burn In

Jan 31, 2025 -

Manchester City X Club Brugge Onde Assistir Ao Vivo E Horario Do Jogo

Jan 31, 2025

Manchester City X Club Brugge Onde Assistir Ao Vivo E Horario Do Jogo

Jan 31, 2025