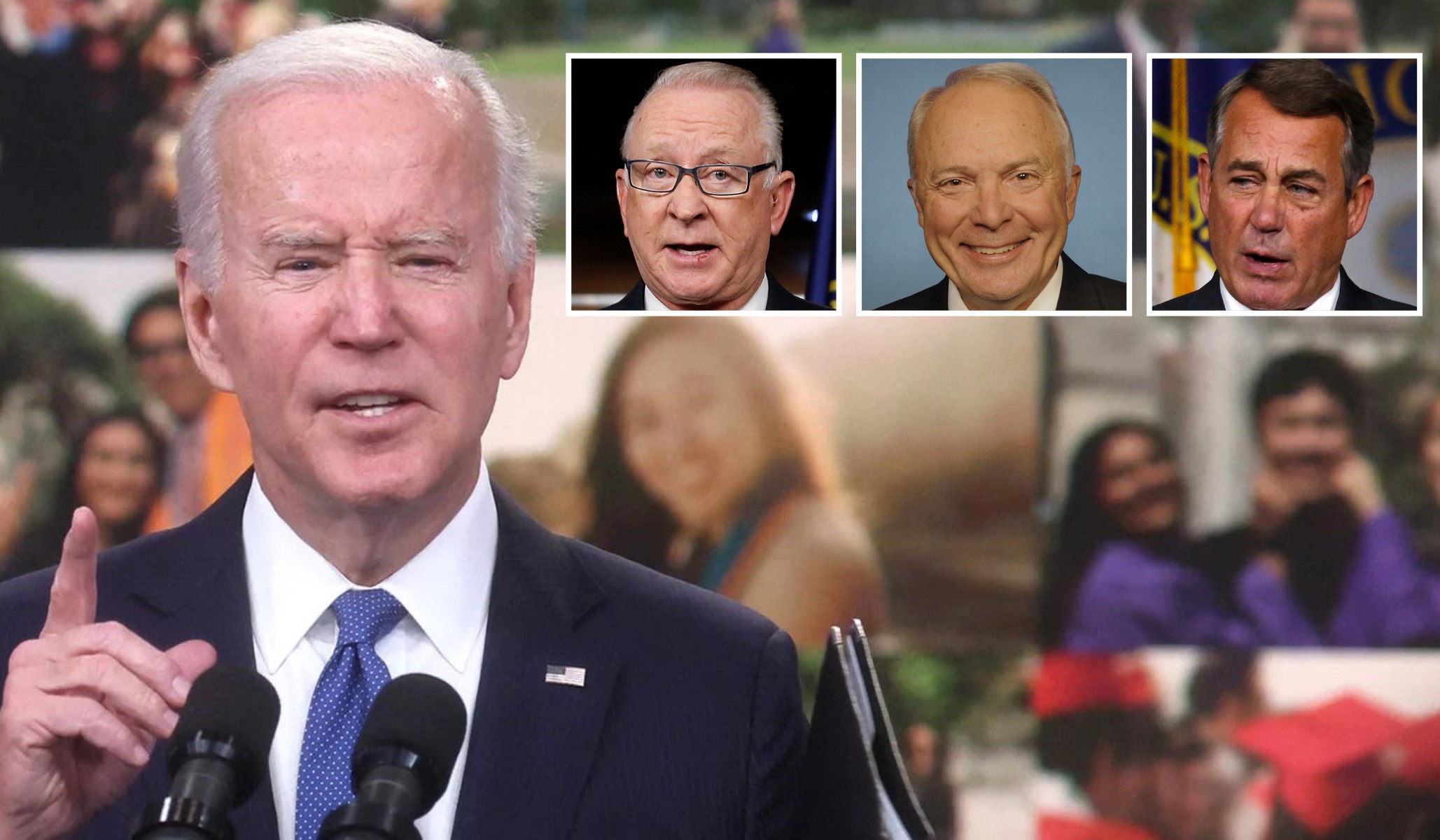

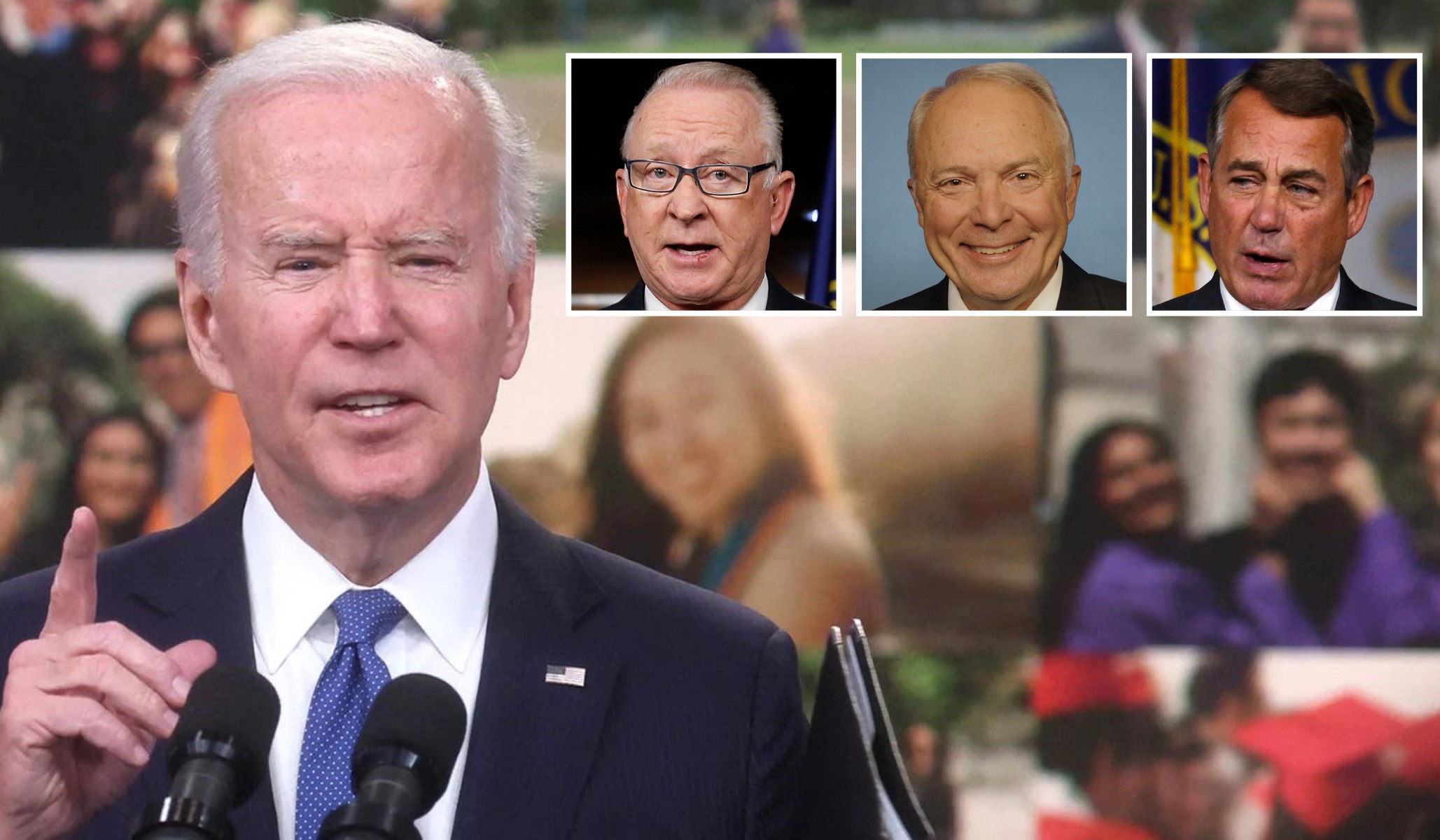

Legal Scholars Challenge Biden's Authority On Student Loan Forgiveness

Discover more detailed and exciting information on our website. Click the link below to start your adventure: Visit Best Website. Don't miss out!

Table of Contents

Legal Scholars Challenge Biden's Authority on Student Loan Forgiveness: A Constitutional Showdown?

President Biden's ambitious plan to wipe out or significantly reduce student loan debt for millions of Americans has ignited a firestorm of controversy, with legal scholars lining up to challenge the administration's authority on the matter. The sweeping initiative, announced in August 2022, promises to alleviate the burden of student loan debt for many, but its legality is now facing intense scrutiny in the courts. This legal battle raises fundamental questions about the executive branch's power and the future of student loan forgiveness programs.

<h3>The Core Argument: Does the President Have the Power?</h3>

The heart of the legal challenge centers on whether the President has the constitutional authority to enact such a wide-ranging student loan forgiveness program without explicit Congressional authorization. Opponents argue that the HEROES Act of 2003, which the administration cites as its legal basis, doesn't grant the President the sweeping powers claimed. They contend that the scale of the forgiveness plan – potentially costing hundreds of billions of dollars – requires Congressional approval.

Legal experts are pointing to several key issues:

- The scope of the HEROES Act: Critics argue the Act was intended for targeted relief in times of national emergency, not a broad-based debt cancellation program. They highlight the lack of specific language authorizing such a massive undertaking.

- Separation of powers: The challenge emphasizes the importance of maintaining a balance of power between the executive and legislative branches. Bypassing Congress on a matter of this magnitude, opponents argue, undermines the democratic process.

- Due process concerns: Some lawsuits argue that the forgiveness plan violates the due process rights of taxpayers who will ultimately bear the cost of the program through increased government debt.

<h3>The Potential Economic and Political Ramifications</h3>

The outcome of these legal challenges will have profound consequences. A court ruling against the plan could leave millions of borrowers facing mounting debt and significantly impact the President's political standing. Conversely, a ruling upholding the plan could set a precedent for future executive action on similar issues.

Economically, the implications are substantial. The potential impact on the economy ranges from stimulating consumer spending to exacerbating inflation, depending on the ultimate outcome. Economists are closely monitoring the situation and its potential effects on various sectors.

<h3>Who's Involved and What's Next?</h3>

Several lawsuits have already been filed, primarily by conservative legal groups and individual taxpayers. The cases are working their way through the court system, with many anticipating a Supreme Court review eventually. Organizations like the Pacific Legal Foundation and the Cato Institute are actively involved in challenging the legality of the program.

The future of the student loan forgiveness plan remains uncertain. The legal battles ahead will likely involve extensive legal arguments about statutory interpretation, constitutional authority, and economic impact.

<h3>Stay Informed: Following the Legal Battles</h3>

This legal challenge to President Biden's student loan forgiveness plan is a landmark case with far-reaching consequences. Keep checking back for updates as this crucial legal battle unfolds and its implications become clearer. Understanding the legal arguments and their potential impact is vital for anyone affected by student loan debt or interested in the intersection of law and public policy. Stay tuned for further developments and expert analysis!

Thank you for visiting our website wich cover about Legal Scholars Challenge Biden's Authority On Student Loan Forgiveness. We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and dont miss to bookmark.

Featured Posts

-

Your Friendly Neighborhood Spider Man Episode 1 Recap And Discussion

Jan 30, 2025

Your Friendly Neighborhood Spider Man Episode 1 Recap And Discussion

Jan 30, 2025 -

Starbucks Misses Earnings Sales Dip Ceo Remains Confident

Jan 30, 2025

Starbucks Misses Earnings Sales Dip Ceo Remains Confident

Jan 30, 2025 -

Unveiling The Gulf Of America And Mount Mc Kinley Via Google Maps

Jan 30, 2025

Unveiling The Gulf Of America And Mount Mc Kinley Via Google Maps

Jan 30, 2025 -

Dua Lipa Y Callum Turner Un Romance En Secreto

Jan 30, 2025

Dua Lipa Y Callum Turner Un Romance En Secreto

Jan 30, 2025 -

Dividend Stocks Vs Buybacks Recession Proofing Your Portfolio

Jan 30, 2025

Dividend Stocks Vs Buybacks Recession Proofing Your Portfolio

Jan 30, 2025

Latest Posts

-

Klopps Team Selection Analyzing Liverpools Rest Strategy Against Psv

Jan 31, 2025

Klopps Team Selection Analyzing Liverpools Rest Strategy Against Psv

Jan 31, 2025 -

No School Buses Today West Parry Sound Cancellation Details And Alternatives

Jan 31, 2025

No School Buses Today West Parry Sound Cancellation Details And Alternatives

Jan 31, 2025 -

Bayern Munich Golea Al Slovan Bratislava Cronica Del Encuentro

Jan 31, 2025

Bayern Munich Golea Al Slovan Bratislava Cronica Del Encuentro

Jan 31, 2025 -

Video Dua Lipa Y Callum Turner Protagonizan Un Baile Inolvidable

Jan 31, 2025

Video Dua Lipa Y Callum Turner Protagonizan Un Baile Inolvidable

Jan 31, 2025 -

Caso Bob Menendez La Condena A 11 Anos Y Sus Consecuencias Legales

Jan 31, 2025

Caso Bob Menendez La Condena A 11 Anos Y Sus Consecuencias Legales

Jan 31, 2025