Significant Shifts In Nasdaq's Mid-Month Short Interest Report

Discover more detailed and exciting information on our website. Click the link below to start your adventure: Visit Best Website. Don't miss out!

Table of Contents

Significant Shifts in Nasdaq's Mid-Month Short Interest Report: What Investors Need to Know

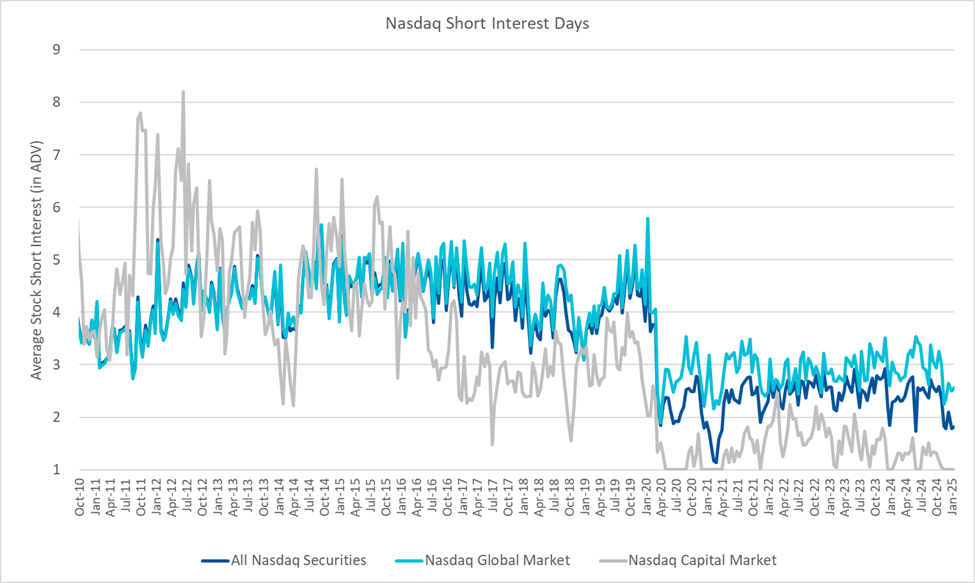

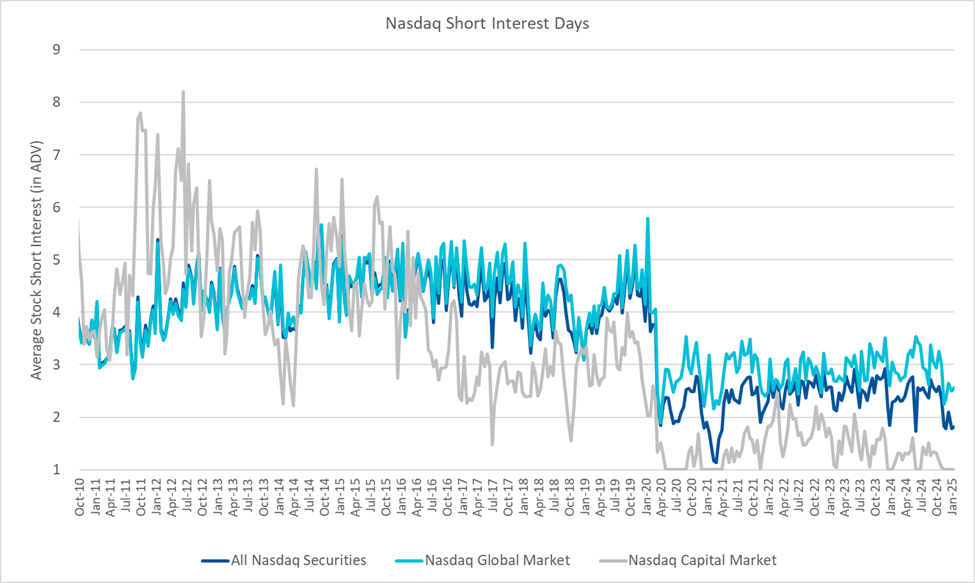

The Nasdaq's mid-month short interest report has dropped a bombshell, revealing significant shifts in investor sentiment and potentially foreshadowing major market movements. This report, released [Insert Date], offers a crucial snapshot of short selling activity across numerous Nasdaq-listed companies, providing valuable insights for both seasoned traders and newcomers alike. Understanding these changes is critical for navigating the complexities of the current market landscape.

Keywords: Nasdaq short interest, short selling, mid-month report, stock market trends, investor sentiment, short squeeze, stock market analysis, market volatility, trading strategy

Key Findings from the Nasdaq Short Interest Report

The report highlighted some dramatic changes in short interest across various sectors. Some key takeaways include:

-

Surge in Short Interest for Tech Giants: Several prominent tech companies experienced a noticeable increase in short interest, suggesting growing bearish sentiment among investors. This could be attributed to [Insert specific reasons, e.g., concerns about slowing growth, increased competition, or recent negative news]. Companies like [Insert specific company examples] saw particularly significant jumps.

-

Decreased Short Interest in the Healthcare Sector: Conversely, the healthcare sector witnessed a decline in short interest, potentially indicating renewed confidence in the sector's prospects. This could be linked to [Insert specific reasons, e.g., positive clinical trial results, regulatory approvals, or strong earnings reports]. Companies such as [Insert specific company examples] benefited from this shift.

-

Volatility in the Energy Sector: The energy sector presented a mixed bag, with some companies showing increased short interest while others saw a decrease. This volatility likely reflects the ongoing uncertainty surrounding [Insert specific reasons, e.g., global energy prices, geopolitical factors, and the transition to renewable energy].

Understanding the Implications of Shifting Short Interest

Fluctuations in short interest are not just random noise; they often act as leading indicators of upcoming price movements. A sudden increase in short interest can signal potential downward pressure, while a significant decrease might suggest an impending short squeeze, leading to rapid price increases. Therefore, carefully analyzing these shifts is crucial for informed investment decisions.

High Short Interest Stocks to Watch: Investors should keep a close eye on the following stocks that experienced notable changes in short interest: [Insert a list of 3-5 relevant stocks with brief explanations].

How to Use this Information in Your Trading Strategy

The Nasdaq's mid-month short interest report is a valuable tool for refining your trading strategy. However, it shouldn't be the sole factor influencing your decisions. Consider integrating this data with other fundamental and technical analyses to form a comprehensive view.

Tips for incorporating short interest data into your strategy:

- Combine with Fundamental Analysis: Don't rely solely on short interest data. Consider a company's financial health, growth prospects, and competitive landscape.

- Identify Potential Short Squeezes: Look for stocks with high short interest experiencing a significant decrease – these could be prime candidates for a short squeeze.

- Manage Risk: Short selling and investing in high-short-interest stocks are inherently risky. Always employ appropriate risk management techniques.

Conclusion: Staying Ahead of the Curve

The Nasdaq's mid-month short interest report provides a crucial window into investor sentiment and potential market movements. By carefully analyzing these shifts and incorporating them into a well-rounded investment strategy, you can significantly improve your chances of success in the dynamic world of stock trading. Stay informed, stay vigilant, and stay ahead of the curve.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Investing in the stock market involves significant risk, and you could lose money.

Thank you for visiting our website wich cover about Significant Shifts In Nasdaq's Mid-Month Short Interest Report. We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and dont miss to bookmark.

Featured Posts

-

Neymar Fin De Contrat Bilan Mitige Apres 7 Matchs

Jan 30, 2025

Neymar Fin De Contrat Bilan Mitige Apres 7 Matchs

Jan 30, 2025 -

De Serpientes Y Pixels Google Recupera Un Clasico

Jan 30, 2025

De Serpientes Y Pixels Google Recupera Un Clasico

Jan 30, 2025 -

White House Tradition Upended Youngest Press Secretarys Debut

Jan 30, 2025

White House Tradition Upended Youngest Press Secretarys Debut

Jan 30, 2025 -

Mini Modric Tag Is Hannibal Mejbri Manchester Uniteds Next Midfield Maestro

Jan 30, 2025

Mini Modric Tag Is Hannibal Mejbri Manchester Uniteds Next Midfield Maestro

Jan 30, 2025 -

Rachael Kirkconnells Reaction To Matt Jamess Decision Blindsided And Heartbroken

Jan 30, 2025

Rachael Kirkconnells Reaction To Matt Jamess Decision Blindsided And Heartbroken

Jan 30, 2025

Latest Posts

-

Analisis Leverkusen Sparta Praga Claves Del Partido Champions

Jan 31, 2025

Analisis Leverkusen Sparta Praga Claves Del Partido Champions

Jan 31, 2025 -

Diphtherie Todesfall In Brandenburg Zehnjaehriges Kind Aus Dem Havelland Betroffen

Jan 31, 2025

Diphtherie Todesfall In Brandenburg Zehnjaehriges Kind Aus Dem Havelland Betroffen

Jan 31, 2025 -

Borussia Dortmund Vs Shakhtar Donetsk En Directo Hoy

Jan 31, 2025

Borussia Dortmund Vs Shakhtar Donetsk En Directo Hoy

Jan 31, 2025 -

Air Force F 35 Explodes In Fireball At Eielson Video Footage Emerges

Jan 31, 2025

Air Force F 35 Explodes In Fireball At Eielson Video Footage Emerges

Jan 31, 2025 -

Champions League Saiba Onde Assistir Rb Salzburg X Atletico De Madrid

Jan 31, 2025

Champions League Saiba Onde Assistir Rb Salzburg X Atletico De Madrid

Jan 31, 2025