Steel Industry Shakeup: Swiss Steel's (STLN) Departure From Swiss Exchange

Discover more detailed and exciting information on our website. Click the link below to start your adventure: Visit Best Website. Don't miss out!

Table of Contents

Steel Industry Shakeup: Swiss Steel (STLN) Departs from Swiss Exchange

The Swiss steel industry is facing a significant reshuffle as Swiss Steel (STLN), a major player in the market, announces its departure from the SIX Swiss Exchange. This unexpected move sends ripples throughout the European steel sector, prompting speculation about future consolidation and strategic shifts within the industry. The delisting, effective [Insert Date], marks a pivotal moment for Swiss Steel and raises important questions about its future trajectory.

Why is Swiss Steel Leaving the Swiss Exchange?

Swiss Steel's decision to delist from the SIX Swiss Exchange is primarily driven by a desire to enhance strategic flexibility and operational efficiency. The company, in its official statement, cited reduced regulatory burdens and increased operational agility as key motivating factors. This move allows Swiss Steel to pursue long-term strategic goals without the constraints of public company reporting requirements. While the company hasn't explicitly mentioned specific plans, analysts speculate this could pave the way for acquisitions, mergers, or other significant strategic initiatives that might not be easily pursued under public company scrutiny.

Impact on Investors and the Steel Market:

The delisting of Swiss Steel (STLN) has several implications for investors and the broader steel market:

- Reduced Liquidity: Investors will find it more challenging to trade Swiss Steel shares, leading to potentially reduced liquidity. Trading will likely shift to other exchanges where the company might list its shares, or over-the-counter (OTC) markets.

- Increased Volatility: The absence of regular reporting and the potential for strategic changes could introduce increased volatility in Swiss Steel's share price.

- Consolidation Speculation: Industry experts are speculating that Swiss Steel's delisting might be a precursor to further consolidation within the European steel industry. This could involve mergers and acquisitions to improve market share and profitability in a competitive global landscape.

- Impact on Swiss Stock Market: The departure of a significant company like Swiss Steel represents a loss for the SIX Swiss Exchange, potentially affecting market capitalization and investor confidence.

Understanding Swiss Steel's Business Model and Future Outlook

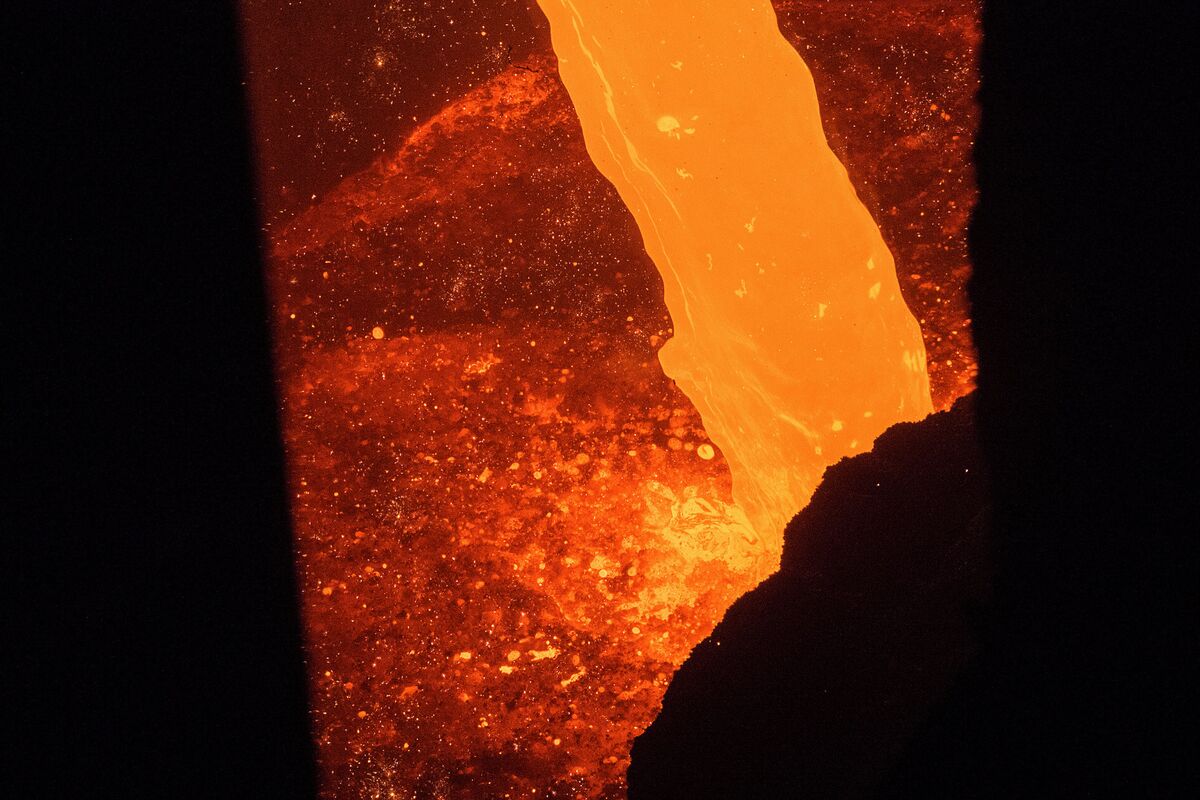

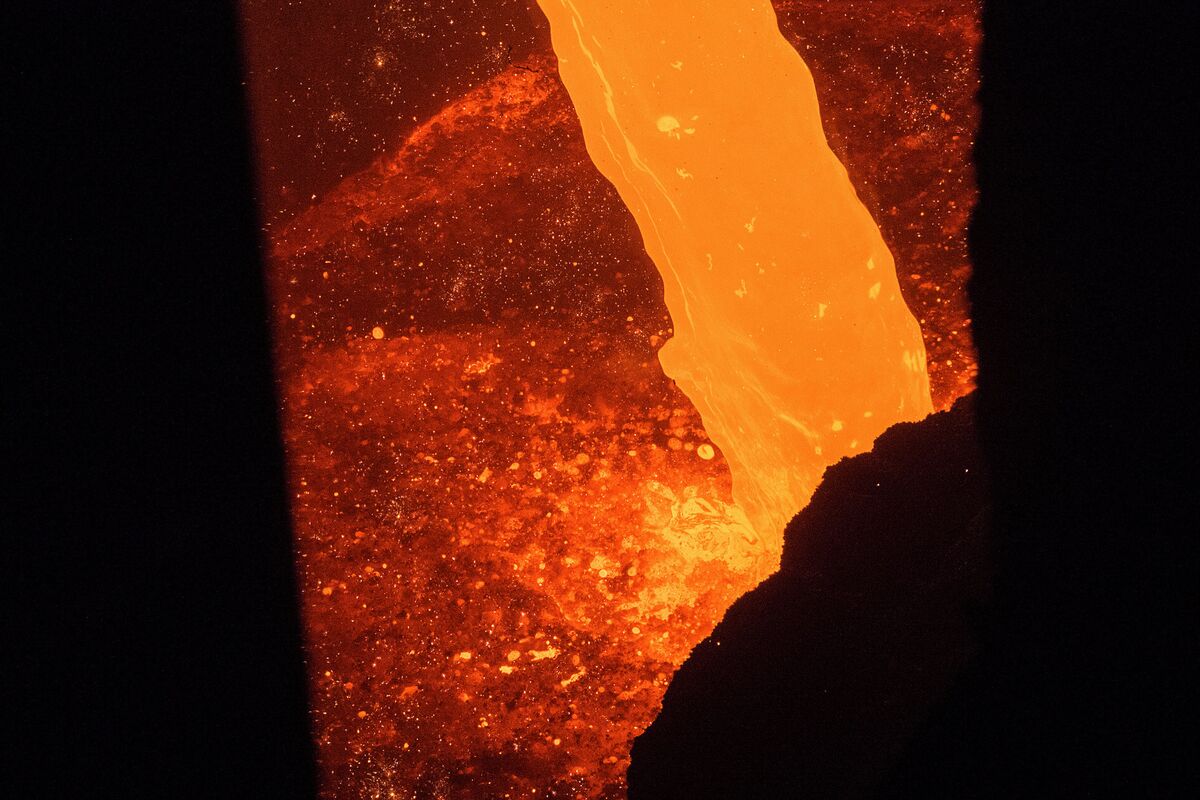

Swiss Steel is a leading producer of high-quality steel products, specializing in specialty steel and alloys. The company caters to various sectors, including the automotive, aerospace, and energy industries. Its move away from the Swiss exchange suggests a focus on long-term strategic planning rather than short-term market fluctuations. The company’s future success will likely hinge on its ability to adapt to evolving market demands and technological advancements in the steel manufacturing industry.

What's Next for Swiss Steel?

While the company remains tight-lipped about specific future plans, the delisting undoubtedly signals a new chapter for Swiss Steel. The increased operational freedom could allow the company to pursue ambitious growth strategies, potentially through mergers, acquisitions, or significant investments in research and development. Industry watchers will closely monitor Swiss Steel's moves to understand the long-term implications of this strategic shift.

Keywords: Swiss Steel, STLN, SIX Swiss Exchange, delisting, steel industry, specialty steel, European steel market, mergers and acquisitions, stock market, investor relations, corporate strategy, steel production, alloy steel.

Call to Action: Stay tuned for further updates on Swiss Steel's strategic initiatives. Follow us for the latest news and analysis on the evolving steel market.

Thank you for visiting our website wich cover about Steel Industry Shakeup: Swiss Steel's (STLN) Departure From Swiss Exchange. We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and dont miss to bookmark.

Featured Posts

-

Chinas Tesla Recall 1 2 Million Cars Get Safety Upgrade

Jan 26, 2025

Chinas Tesla Recall 1 2 Million Cars Get Safety Upgrade

Jan 26, 2025 -

Coches De F1 A Escala La Nueva Coleccion De Hot Wheels

Jan 26, 2025

Coches De F1 A Escala La Nueva Coleccion De Hot Wheels

Jan 26, 2025 -

Proces Pour Denutrition Le Destin Tragique D Amandine 13 Ans

Jan 26, 2025

Proces Pour Denutrition Le Destin Tragique D Amandine 13 Ans

Jan 26, 2025 -

Sinner Vs Zverev El Partido Que Pudo Ser En El Abierto De Australia

Jan 26, 2025

Sinner Vs Zverev El Partido Que Pudo Ser En El Abierto De Australia

Jan 26, 2025 -

Confirmed Whittakers Departure From Plymouth Argyle

Jan 26, 2025

Confirmed Whittakers Departure From Plymouth Argyle

Jan 26, 2025

Latest Posts

-

L Impact De Forza Horizon 5 Sur Le Marche Xbox Decryptage

Feb 01, 2025

L Impact De Forza Horizon 5 Sur Le Marche Xbox Decryptage

Feb 01, 2025 -

Man Shot Dead In Sweden Following Koran Burning Authorities Investigating

Feb 01, 2025

Man Shot Dead In Sweden Following Koran Burning Authorities Investigating

Feb 01, 2025 -

6 Nations 2025 Horaires Chaines De Television Et Arbitres Designes

Feb 01, 2025

6 Nations 2025 Horaires Chaines De Television Et Arbitres Designes

Feb 01, 2025 -

What The Syrian Secret Police Observed During The Regimes Downfall

Feb 01, 2025

What The Syrian Secret Police Observed During The Regimes Downfall

Feb 01, 2025