Student Loan Debt Relief: Key Architects Question Biden's Legal Power

Discover more detailed and exciting information on our website. Click the link below to start your adventure: Visit Best Website. Don't miss out!

Table of Contents

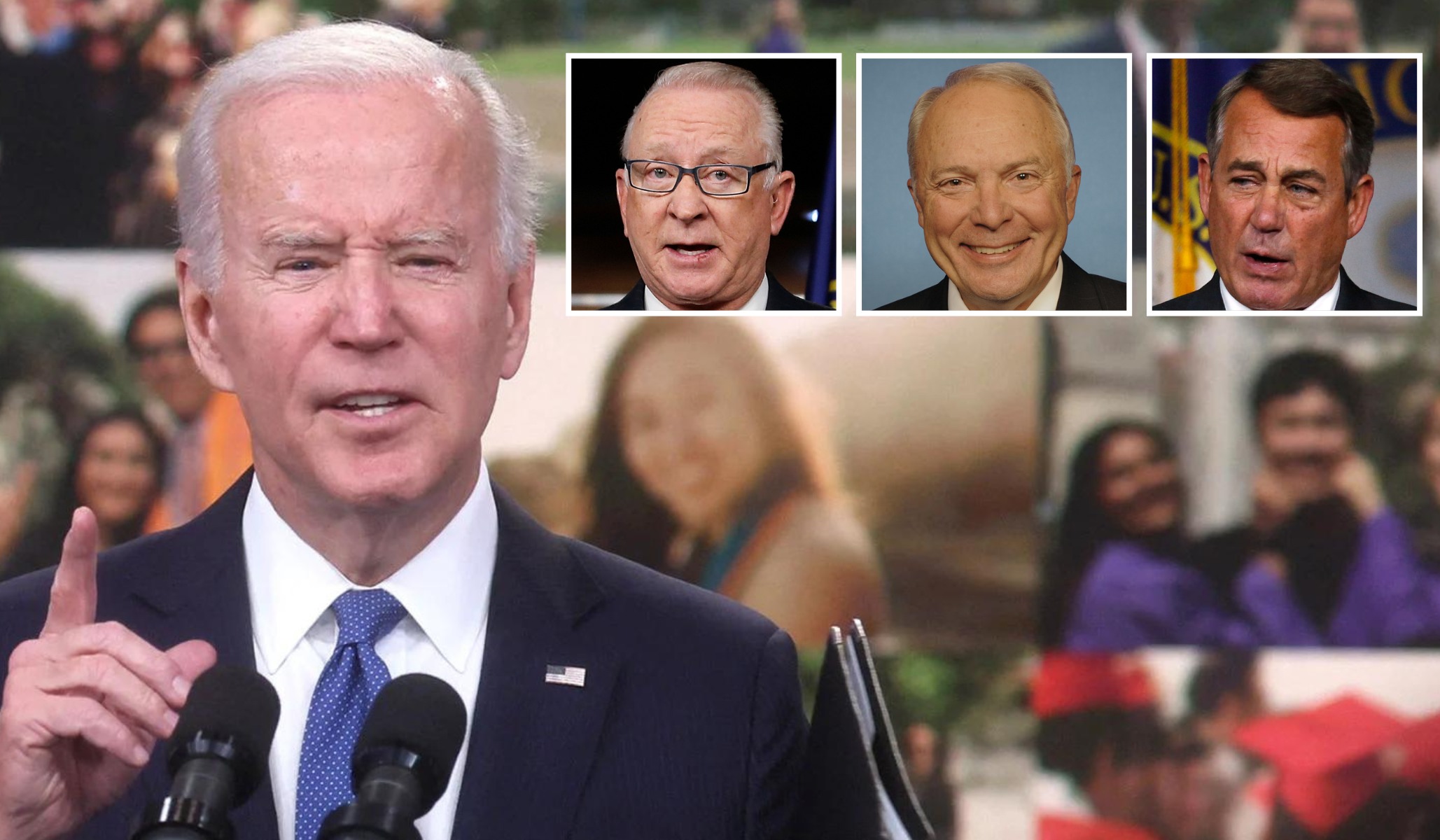

Student Loan Debt Relief: Key Architects Question Biden's Legal Authority

President Biden's ambitious plan to wipe out or significantly reduce student loan debt for millions of Americans is facing serious legal challenges. The program, lauded by supporters as a crucial step towards economic equality, is now embroiled in controversy as key architects of the Higher Education Act itself question the administration's legal authority to implement such a sweeping policy. This raises significant questions about the future of student loan forgiveness and the potential for legal battles that could drag on for years.

The proposed plan, which would cancel up to $20,000 in student loan debt for eligible borrowers, has been met with both enthusiastic support and staunch opposition. While proponents celebrate its potential to boost the economy and alleviate financial strain on millions, critics argue it's an overreach of executive power and unfair to those who diligently paid off their loans. This legal uncertainty adds another layer of complexity to an already contentious issue.

Legal Scholars and the Higher Education Act of 1965

The heart of the legal challenge lies in the interpretation of the Higher Education Act of 1965 (HEA). Several legal scholars, including those who played instrumental roles in shaping the HEA, are publicly questioning whether the Secretary of Education has the statutory authority to implement such a broad-based student loan forgiveness program. They argue that the Act provides specific mechanisms for loan modification and discharge, but none that grant the executive branch the power to unilaterally cancel billions of dollars in debt.

- Specific concerns include:

- Lack of explicit Congressional authorization for such a large-scale debt cancellation.

- Potential violation of the Administrative Procedure Act (APA) due to lack of sufficient notice and comment periods.

- Concerns about fairness and equity, arguing the program disproportionately benefits higher earners.

The Ongoing Legal Battles and Potential Outcomes

The legal challenges are far from settled. Several lawsuits have already been filed, challenging the legality of the plan on various grounds. The outcome of these lawsuits could significantly impact the lives of millions of borrowers. A successful challenge could invalidate the entire program, leaving borrowers facing the prospect of continued debt repayment. Conversely, a court upholding the program could pave the way for similar initiatives in the future.

Potential outcomes include:

- Complete invalidation of the program: This would require borrowers to resume their loan payments.

- Partial invalidation: Certain aspects of the program might be deemed unlawful, leading to modifications.

- Full upholding of the program: This would allow the program to proceed as planned.

What This Means for Borrowers

The uncertainty surrounding the legality of the student loan debt relief plan leaves borrowers in a state of limbo. While the application process is underway, borrowers should remain informed about the legal developments and potential impacts on their individual circumstances. It's crucial to stay updated on any court decisions and their implications for your student loans.

For now, borrowers should:

- Monitor news and legal updates: Stay informed about the legal challenges and their progress.

- Continue to make payments (if applicable): Unless otherwise directed, continue making payments to avoid default.

- Consult with a financial advisor: Seek personalized advice on how to manage your student loans given the current uncertainties.

The legal challenges to President Biden's student loan debt relief plan represent a significant hurdle for the administration. The outcome will have far-reaching consequences for millions of Americans burdened by student loan debt, potentially reshaping the landscape of higher education financing for years to come. The situation warrants close attention from both borrowers and policymakers alike. We will continue to update this article as the legal battle unfolds.

Thank you for visiting our website wich cover about Student Loan Debt Relief: Key Architects Question Biden's Legal Power. We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and dont miss to bookmark.

Featured Posts

-

Tras Varios Anos Tiago Volpi Abandona El Toluca Fc

Jan 26, 2025

Tras Varios Anos Tiago Volpi Abandona El Toluca Fc

Jan 26, 2025 -

Dschungelcamp 2025 Der Luxus Check Der Promi Kandidaten

Jan 26, 2025

Dschungelcamp 2025 Der Luxus Check Der Promi Kandidaten

Jan 26, 2025 -

Data E Horario Cleveland Cavaliers X Philadelphia 76ers

Jan 26, 2025

Data E Horario Cleveland Cavaliers X Philadelphia 76ers

Jan 26, 2025 -

Sinners Triumph Australian Open Final Return

Jan 26, 2025

Sinners Triumph Australian Open Final Return

Jan 26, 2025 -

Deep Seeks Ascent Tech Leaders React

Jan 26, 2025

Deep Seeks Ascent Tech Leaders React

Jan 26, 2025

Man Shot Dead In Sweden Following Koran Burning Authorities Investigating

Man Shot Dead In Sweden Following Koran Burning Authorities Investigating

6 Nations 2025 Horaires Chaines De Television Et Arbitres Designes

6 Nations 2025 Horaires Chaines De Television Et Arbitres Designes

What The Syrian Secret Police Observed During The Regimes Downfall

What The Syrian Secret Police Observed During The Regimes Downfall